What’s The Point of Doing Financial Projections? They Will Always Be Wrong!

Improving a Process Fraught with Misalignment

“Trying to predict the future is like trying to drive down a country road at night with no lights while looking out the back window.” — Peter Drucker

Life is filled with uncertainty. One certainty is that all financial projections will be wrong.

However, budgets are a requirement in modern business. So how might one find nuggets of gold in a process that is usually painful?

Focus on the Journey, not the Destination

This advice applies equally well to doing financial projections as to living. The ‘journey’ includes evaluating historical performance, debating assumptions, running scenarios, looking at trendlines, and comparing how the key metrics compare to relevant industry benchmarks.

The journey is about deepening our learning about what matters to business outcomes through being open to new information and getting comfortable with uncertainty.

An Exception — When the Destination does Matter

(Apologies for almost immediately contradicting myself.)

The destination (outputs) does matter when either fundraising or selling the business. In either case, creating projections is part of ‘playing the game’ where the primary goal is to sell a vision about the future that could be. (See this link to the piece I wrote a few years ago about this process for more details.)

The Insights and Value that can arise from doing Financial Projections

Recognizing that the Future Matters

Business valuation is based on what people believe about the future. The question to be answered is: “What might the future (of the business) look like?”

The forecasting process allows a management team to form a thoughtful opinion on what the future state of the business might look like and develop a path to get there that is both realistic and achievable.

Setting Goals (and Delivering on the Promises)

Having clearly articulated goals helps everyone prioritize, focuses attention, and provides targets (along with starting points) against which to measure progress.

The process of goal setting should include debating priorities and arriving at a short(er) list of items that really matter. Don’t simply settle for goals that are easy to measure or the ones that your peers in the business world have used (though certainly take that into consideration.)

While it is easy to make all goals financial metrics, I would advise having at least one that is related to customer satisfaction and another to employee satisfaction.

Transparency on progress both helps expose problems and increases focus on achieving the goals.

Investors appreciate when businesses live up to commitments and deliver on promises. In the public markets, companies that meet their projections are much more highly valued than those that don’t.

In uncertain environments (such as those faced by most growing private companies today), I would advise setting less ambitious goals and exceeding them than shooting for the moon and missing.

Accountability and Alignment

Most financial projections become a public document (at least in summary form) that is shared with the key stakeholders (usually investors and employees).

Accountability arises from making a public declaration of intentions, especially when there is a cost to missing them. A well run forecasting process involves (i) clearly stating goals; (ii) pushing them down throughout the organization, (iii) documenting specific steps with timelines to be taken in pursuit of the goals; and, (iv) partnering cross functionally as required. When these steps are taken the likelihood of achieving the goals increases. (Here’s a podcast with some data from Professor Katy Milkman and others on this topic of accountability and ‘tandem goals’.)

Goal alignment and general agreement on how best to achieve the goals is a key differentiator between a well run business and an average business. The forecasting process is a starting point for team alignment.

Gaining a Deeper Understanding of the Business and the Key Drivers

The process of doing financial projections with appropriately detailed assumptions creates a deeper understanding of what actually drives business and financial outcomes.

Investors want senior management (especially the CEO and CFO) to deeply understand what inputs matter to driving business outcomes, and be able to articulate them clearly. Doing a detailed financial plan, especially when it includes writing out the key assumptions (and why they matter) deepens business understanding and prepares one to communicate priorities more clearly and answer questions from all relevant stakeholders.

Awareness of a Range of Possible Outcomes (Scenario Planning)

All budgets include a series of new initiatives (often referred to as bets) to drive value creation. All budget processes should identify each such ‘bet’.

Each bet will have a range of different payoffs with probabilities attached to each potential payoff. While it is nearly impossible to agree on probabilities and payoffs, they are worth discussing.

The debate will then turn to how many and which bets to undertake — those with the highest likelihood of success or those with the highest expected value.

Investors (like venture capitalists) with multiple uncorrelated investments might optimize their outcomes by maximizing expected value. However, business leaders who are playing one game at a time and serve stakeholders with different risk appetites should take a different approach and adopt something like what the Kelly criterion recommends or maybe even be more conservative.

Thinking Long Term

A lot of day-to-day work is time spent ‘in the business’ attending to immediate priorities to move the ball forward and reacting to inbound requests.

In most organizations, there is not enough slack to allow even senior leaders to step back from their day-to-day responsibilities and spend even a few days a month ‘on the business’.

Working on the business involves thinking longer term, trying to improve the understanding of customers and the problems they want to solve, as well as considering ways to innovate and bring new products or services to life.

If there is sufficient time to do a projections process (which is the exception rather than the norm), I recommend setting aside time for the leadership team to spend time thinking about and discussing the long term vision for the business.

Other Elements of a Well Run Projections Process

Disproportionate Time Allocated to Thinking About Revenue Drivers

Revenue is harder to forecast than expense. Revenue depends on assumptions outside the company's control. Price and volume are influenced by the macro-economic environment, the available substitutes, and the actions of competitors. Forecasting these inputs with any accuracy requires thinking through the whole Go-To-Market process and the 4 P’s — items such as the target audience (or ICP), how to find them efficiently (distribution/place), the unique selling or value proposition and communicating it well, objection handling, the time from awareness to purchase etc. etc.

Be sure to set aside sufficient time to discuss revenue drivers. Accept that the debate will be less grounded in certainties and more unstructured.

Outputs Presented as Ranges

Point estimates for financial targets are foolish. Point estimates suggest a level of confidence and accuracy that we all know is unwarranted.

Missing the forecast (for revenue or operating income or free cash flow) by 1% should not make you a pariah. Nor should exceeding it by 1% make you a hero.

Discuss with your Board the possibility of using a forecast range. They will likely object. And while it may not work for incentive compensation plans, it is a wiser way to think about future business performance.

Pre-Mortems (on why we might have missed or beaten the forecast)

While we are poor at making accurate predictions, we are excellent at explaining (after the fact) why reality turned out differently.

Engage in pre-mortems to identify the most likely reasons (with a deeper dive into those within your control) that the business might exceed or miss its budget. Identify how you might mitigate the negative and lean into the positive. Track leading indicators that provide signals of when things are going poorly or particularly well.

Realistic Goals; but, not too Easy

Goals must be achievable without being a slam dunk. Unrealistic goals are demotivating. And slam dunks don’t encourage the team to try extra hard and put their best foot forward. Finding the appropriate middle ground is challenging.

As a CEO or CFO, you have likely achieved a good balance if the investors are pushing for higher targets and the revenue organization (who typically has meaningful incentive compensation at risk) is complaining that the goals are too high.

Cushion Built into the Cost Structure

Businesses have a much greater degree of control over cost structure than revenue. All businesses, particularly those that have signed up for ambitious revenue projections, will have built some cushion into the cost structure. This cushion exists to help offset misses on revenue and cash inflows.

Combating Incentive Misalignment

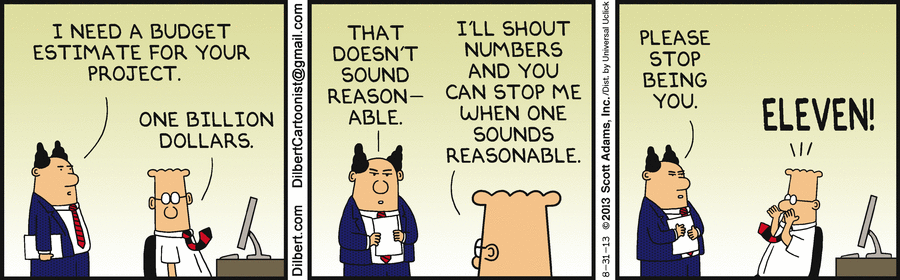

The projections process is fraught with incentive misalignment.

Some parties are ‘buyers’ (most senior leaders and anyone with meaningful incentive comp plans) who want the lowest reasonable targets. Others are ‘sellers’ (such as shareholders and their Board representatives) who want to push for the highest possible targets. Still others, particularly the CEO and CFO, straddle both roles and need to convince both pure buyers and pure sellers that the projections are fair.

If you incorporate some of the ideas from the article above, I believe your budgeting and forecasting process will improve. And while it may not always lead to the company beating its forecast, you will know you were more thoughtful in establishing a forecast.

How should a CFOs variable comp be built to avoid the CFO becoming a buyer and biased towards lowering the targets?