Start-Up Founders Know the Destination but Not the Path to Get There

Specific Steps That Will Help Extend Runway in a Difficult Market Environment.

“If current revenue growth trends continue and expenses stay flat, does the business get to profitability before its cash runs out?”

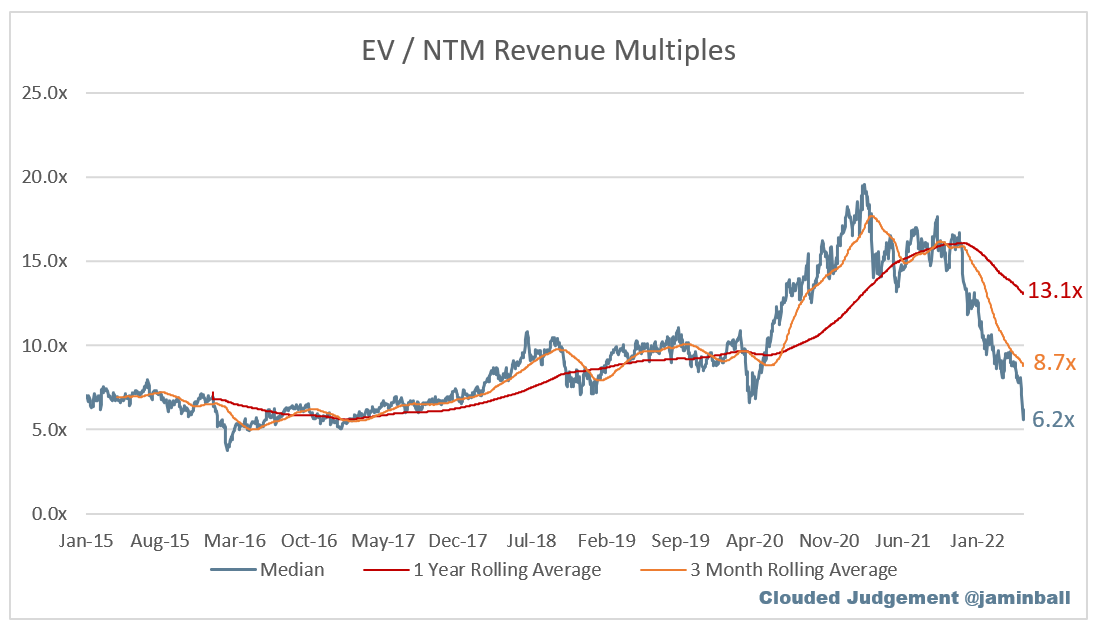

This simple question from Paul Graham’s famous October 2015 article, “Default Alive or Default Dead?” is incredibly important right now with the steep correction in valuation multiples placed on high-growth technology businesses.

For myriad high growth technology companies, even those with almost $100MM in ARR, the answer to the Paul Graham question is ‘NO.’

WHAT, WHY and WHERE

Recent content (articles and videos) from respected venture capitalists does a very good job of explaining ‘WHAT has happened’, ‘WHY it happened’ and ‘WHERE start-ups need to be to raise additional funding.’ I recommend reading or listening to all of these.

Video from Craft Ventures (David Sacks and Jeff Fluhr.);

Article from a16z (Justin Kahl and David George.);

Blog post from Founders Fund (John Luttig.)

YC advice to its companies. (Twitter post and YouTube video.)

WHAT: Cloud Stock Forward Revenue Multiple over Time

WHAT: Last 6-Months: Nasdaq and Cloud Index Stock Performance

WHERE: Targets for Financial Metrics.

This is graphic on the Big Five SaaS business model metrics from the recent video released by Craft Ventures. I suggest all founders / finance leaders benchmark where their businesses are currently, knowing that you likely won’t be great.

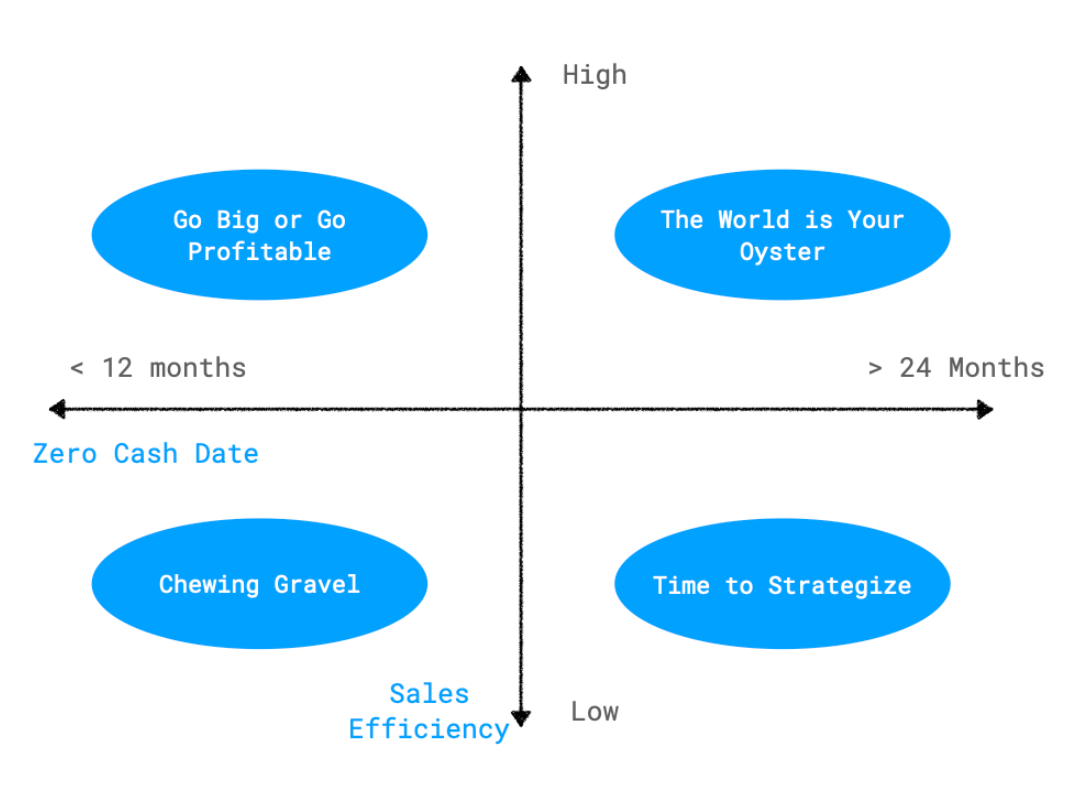

Tom Tunguz just published a 2 by 2 matrix in ‘4 Start-Up States During a Recession.’ to explain the big picture choices facing start-ups.

Most venture-backed start-ups are not in the top right quadrant. (If you are, then this article does not apply to you.)

The last few years have been about optimizing for growth at the expense of burn. In other words, sales efficiency has been a less important variable. And the expectation that it will be easy to raise capital has led companies to assume they can raise new capital at any time (meaning the zero cash date might be much shorter than in prior decades.)

THE STEPS TO TAKE: ‘HOW’ TO GET TO THE DESTINATION.

It is important to acknowledge that:

There is no single road, most common path or specific steps that start-ups should follow to navigate difficult times, achieve their vision and create financial success for employees and shareholders.

My goal in the rest of this article is to build on the wisdom shared by venture investors by taking a deeper dive into ‘HOW’ to stay alive through this challenging period.

The Big Questions to Debate

Discuss these questions with your Leadership Team before building any new financial plan.

How Do We Create More Optionality? Optionality is defined as, “The value of additional optional investment opportunities available only after having made an initial investment.” Increasing optionality means investing in ‘projects’ that offer quick feedback loops (i.e., works well, works ok, doesn’t work at all) and allows for secondary decisions based on the feedback. More optionality leads to more chances to find a successful financial outcome in the future.

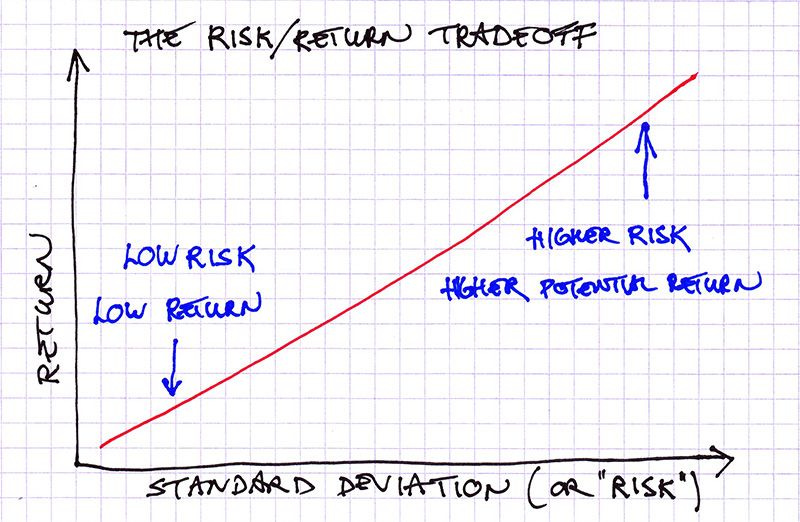

How Much Risk are We Willing to Take? There is no free lunch: meaning trying for ‘better’ outcomes creates additional risks which often drive ‘worse’ outcomes. To bring in a golf metaphor: You are on the tee box of short par four, with a narrow fairway, water in front of the green and bunkers all around. Do you use the driver to have a chance at a birdie or do you lay-up with an iron and play for a par? There is no right answer here, though most CFOs would counsel taking less risk in market environments where uncertainty is as high as it is today.

How Much Does Valuation Matter? One often unasked question is at what valuation should the business be willing to raise money at in the future? Is the last round valuation a line in the sand? Is a down-round valuation acceptable, even if undesirable?

My Answers:

When I have been asked for advice by CEOs/founders, this is what I tell them.

Narrow the Aperture on Risk. Trade off lower growth rates (lower returns) for lower burn rates (lower risk.) Move towards the lower left end of the line shown below. This decision should help extend the runway.

Extend your Runway. First reduce monthly net burn. Also explore raising additional capital (both debt or equity) while knowing it will be very hard in this environment.

Valuation is only important in the long-term, when you sell for cash. Focus on the war (eventual sale for cash or a liquid public security) not the battle (what valuation you can raise the next round at.) Live to fight another day.

You may have a decent business and still have to raise in 12-24 months from now at a down round valuation. That has more to do with the multiple at which the last round was raised - likely at an all time high - compared to what the current market multiple is for high growth companies.Don’t pollute your cap table and raise optimizing for valuation which will require a ‘dirty term sheet.’ (see Bill Gurley’s recent tweet on this.)

Steps to Extend Runway

A. First cut headcount. Don’t just freeze hiring.

There will be a lot of pressure to freeze hiring. And likely reduce headcount. Even large public companies are talking about this. Facebook has announced a hiring freeze; Uber has said hiring is a luxury. Your Board will pressure you to be like the other average venture-backed business.

Cut all ‘mediocre’ people; other companies will do so too. More people will be looking for work and you will find quality replacements should you want. This sounds Machiavellian and I don’t mean to be glib nor do I enjoy firing people. Sadly it likely has to be done. You will build loyalty with those people you keep if you are able to differentiate between performers who are average, above average and excellent. People want to work around other excellent people.

Focus on headcount cuts in this order: (i) G&A / Operations (if you have a lot of people, which many start-ups don’t); (ii) Sales & Marketing with a focus on bottom of the funnel; keep the best salespeople, feed them with more leads and let them kill it on quota achievement; (iii) Product managers (again if you are heavily staffed in this area.)

Outsource the non-core people spend. Consider fractional executives or firms that provide some of these services from lower cost jurisdictions.

Treat those you let go well. Pay several months of severance and cover health insurance for multiple months. As much as possible, do layoffs in person or at least 1:1 over Zoom.

Treat the best people who you keep equally well. Consider raises to offset inflation (if the salaries have not changed for a while.) Reset the option strike prices (see 4b below.) Spread out the value of these incremental benefits over time so those who stay have something to look forward to.

What Else?

B. Raise prices. Test elasticity of demand.

The net effect of pricing increases may be increased revenues which offset the losses of highly cost-conscious customers. Definitely test higher pricing with customers who are low (<20%) or negative gross margin.

C. Collect faster. Use customer payments to fund your business.

Update your incentive compensation plans to pay higher commissions for contracts that have annual, in-advance payment terms. Restructure payment of commissions to happen the month after the customer pays.

Raise prices for those customers paying semi-annually, quarterly or monthly (or discount.)

D. Convert some part of salaries into equity. Reset incentives to help retain your best employees.

Start at the top with CEOs, founders and co-founders making this commitment

Reprice options with the next 409a; do this proactively. Find ways to ensure employees who stay can buy their options in the most tax efficient manner (e.g., using an Equity bee or something similar.)

E. Rethink the Go-To-Market strategy and focus —> Increased Sales Efficiency.

Focus on CAC payback months (gross margin) not LTV:CAC ratios.

Do all analysis at the segment level. Averages are highly misleading. Use the data to figure out which segment or sub-segment to focus your marketing and sales energy on.

Narrow your ICP further. Find the industries where you can close more quickly and have higher opportunities for conversion rates.

Delay geographic expansion outside your core market. Be extra careful on currency exposure as the macro-environment is leading to high volatility in currency exchange rates.

Deprioritize clients who seem sexy but where integrations / going-live is time consuming or costly.

Have fewer AEs and BDRs and let them beat their quotas.

Deprioritize any marketing spend that is not measurable. Link marketing spend with incremental contribution margin not just incremental sales.

Don’t get trapped selling to only venture-backed start-ups. This ended up causing the downfall of AOL and Yahoo!.

Give extra attention to your best customers and push for referrals to lower CAC.

F. Cost Control Beyond People and GTM.

Manage SaaS spend. Companies have fallen in love with a software solution for every automation challenge. Figure out where seats are needed. Hire a vendor such as Tropic (disclosure, I advise them) to help reduce software spend costs.

Reduce rent costs even further. People don’t want to spend every day in the office, so the amount of space is probably still far too much.

This Process Won’t Be Easy

Reconciling the vision (huge business opportunity that solves a big problem which attracted investors to your start-up) with the uncertain market environment (short-term reality of macro and micro challenges) is truly hard.

It’s hard to attract and retain people without selling the vision of what could be. And, it may be impossible to survive without addressing the realities of cash constraints in the near term.

I would err on the side of doing more than less. On a recent episode of the All In podcast they used the metaphor of running a company being like playing at a poker table where you can’t buy back in. If that is the situation, your willingness to take risks in ‘betting’ (and potentially be forced out of the game if you guess wrong) goes down.

In this environment I would counsel finance executives that a good way to know you’ve reached a reasonable outcome is when you have agreed on business changes (including cost reductions) to extend runway by 6-12 months and the CEO feels you have gone too far. If the CEO is comfortable with all the changes, then you probably haven’t done enough.